Top 3 Takeaways From Our Compensation AMA

Sep 04, 2019

4-min read

Techstars Talent hosted an AMA with Katelyn Dennis, Head of Customer Success at Advanced-HR to understand how founders can leverage the Venture Capital Executive Compensation Survey data to optimize their compensation strategy. If you missed the AMA, you can watch the recording here.

Our top three takeaways from the event:

01. Use the Right Data

02. Communicate Value Clearly

03. Incentivize Retention

01. Use the Right Data

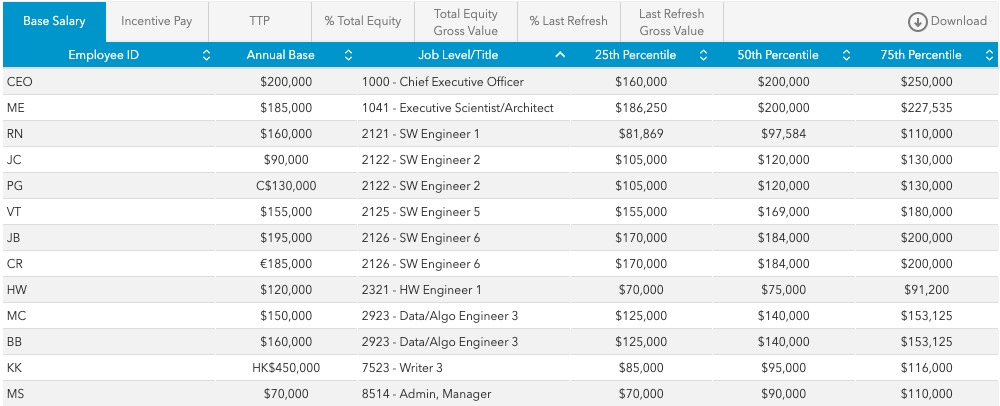

There’s not one right way to do compensation. Compensation should be specific to your company and the Compensation Philosophy you’ve put in place. But, as you’re figuring out what the right mix of salary, equity, and bonus might be for a particular role, there are a few recommendations on how to leverage the right data for benchmarking. First, Katelyn recommends you look for a comparable data set and use that as a reference point. She points out, “as a seed-stage firm you might think ‘I should compare my compensation to other seed stage firms,’ but funding rounds have morphed so much over the last 5 to 10 years that using that approach is not necessarily going to give you a comparable data set.” Instead, Katelyn recommends using a Capital Raised data set because it will allow you to compare yourself to a company with similar resources.

Something else to keep in mind when benchmarking compensation is matching jobs based on “best fit.” When you’re compiling a data set from thousands of private IPO-backed companies with small numbers of employees - there won’t always be a perfect match for your specific industry, location, and unique job responsibilities. In this scenario, Katelyn recommends you start with a broad scope and narrow your search from there. An example she gives would be to use “software engineering” as the job family “regardless of if it’s a front end or back end engineer.” Something else you can do to align your roles with the broader data set is to pull a whole data family instead of just individual joles, and making sure those levels make sense in relation to each-other before you narrow in on one.

02. Communicate Value Clearly

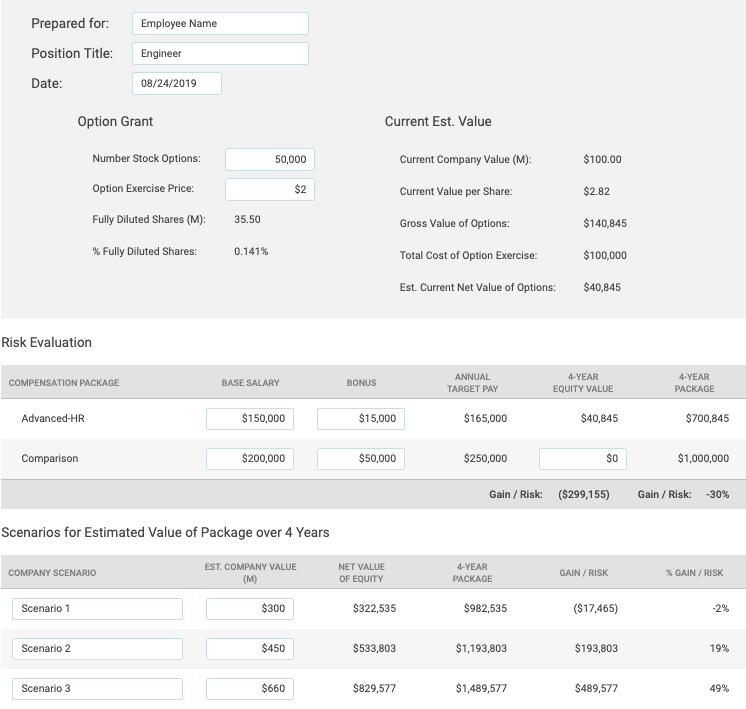

Oftentimes in a startup you will be offering your employees more equity and less cash. As Katelyn points out, “you want to make sure you aren’t asking employees to risk 30% of their compensation package for a potential upside of 10%, that doesn’t make sense, the equity needs to payout exponentially.” In this instance, it’s critical that you communicate the risk and value of that equity in a way that’s clear to the employee. What she recommends doing is looking at the compensation package you plan to offer an employee and analyzing that based on three different exit scenarios: conservative, probable, and hopeful (see table below). That can help you understand the risk related to potential upside in the offer you’re making. Then, during the offer process, you should help the employee understand the analysis you’ve done and what risk or value you see in each scenario.

03. Incentivize Retention

Budget and Affordability should be the main driver for your compensation plan. “If you don’t have the cash resources, you can’t pay with what the market is doing.” In these situations you can use other levers to enhance your offering like benefits, equity, or unlimited vacation. But keeping in mind that “your compensation plan needs to reflect what you can realistically afford.”

In line with that, you should consider how you allocate your resources to incentive top talent in the organization. Obviously, you want your high-performers and those with critical skills for the business to be incentivized to stay. In these circumstances, Katelyn recommends giving retention grants.

The table below outlines how you might think about a Retention Grant program. Reading left to right, you likely have 10-20% of your company who are top-performers with critical business skills - those are the employees that should be targeted in the highest range and given recurring grants at 25% the value of a new hire grant.

Where a typical new hire grant will have a 1-year cliff and a 3-year vest afterward, your retention grants should be the reverse. Katelyn recommends you award retention grants to your top talent annually and structure them with a 3-year cliff and a 1-year vest to incentivize retention. For example: a new hire who starts in January 2019 would receive a standard new hire grant that begins vesting in January 2020. One year later, they are clearly a critical high-performer in the company so they also are rewarded a Retention Grant in January of 2020 which doesn’t begin vesting until January 2023 (year 4 of their employment).

Want to see more content like this? Check out Sabrina Kelly’s piece on Building a Compensation Philosophy.